Debt Service Coverage Ratio (DSCR) A Calculation Guide PropertyMetrics

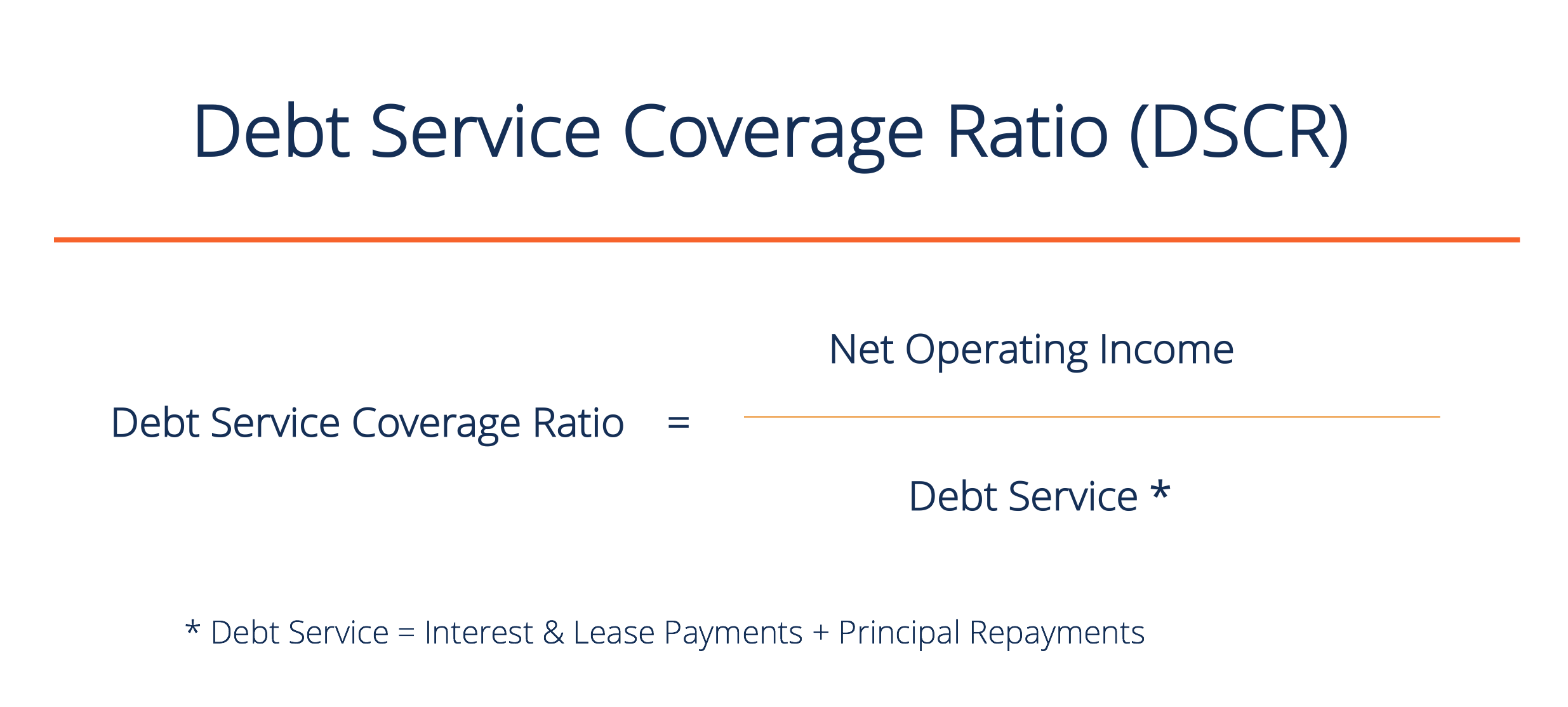

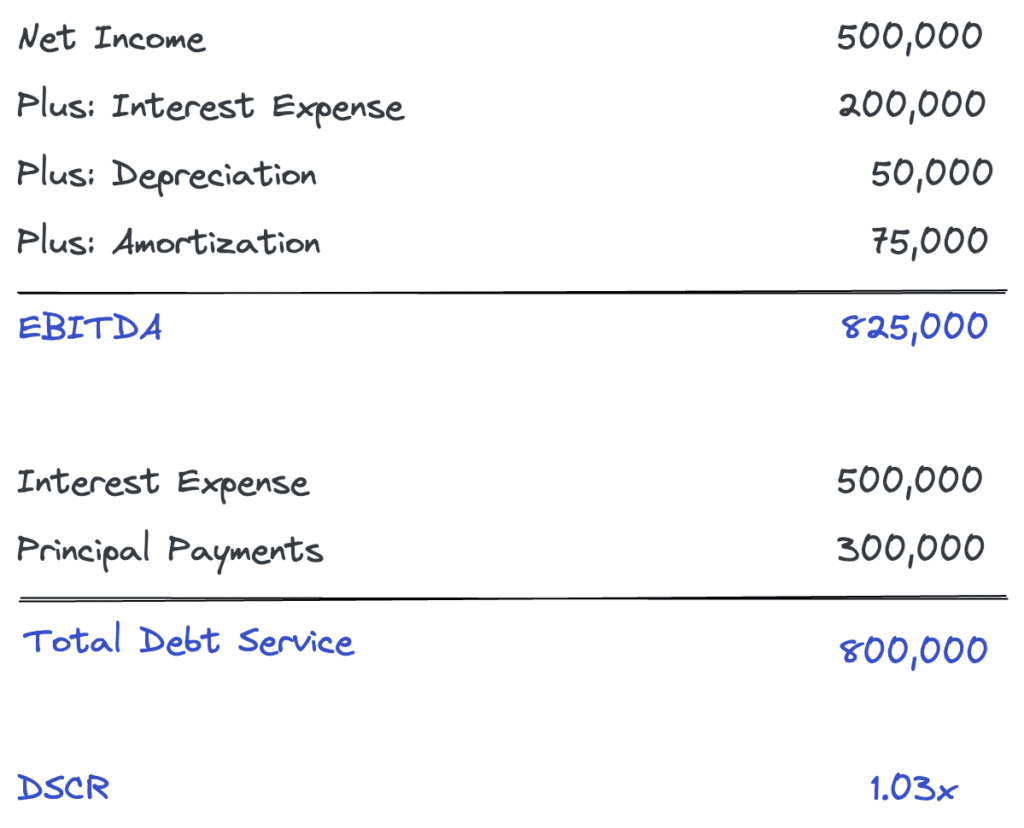

The debt service coverage ratio formula utilizes the company’s net operating income and current debt obligations. DSCR = Net Operating Income / Debt Service. Net operating income equates to.. Maintainance = $200. Insurance = $50. Total debt service = $2,750. Apply the DSCR formula: DSCR ratio = NOI/total debt service. Substitute the values and calculate: DSCR = 5000/2750. DSCR = 1.82. To qualify for a DSCR loan, most lending institutions require a DSCR of 1.25 or greater.

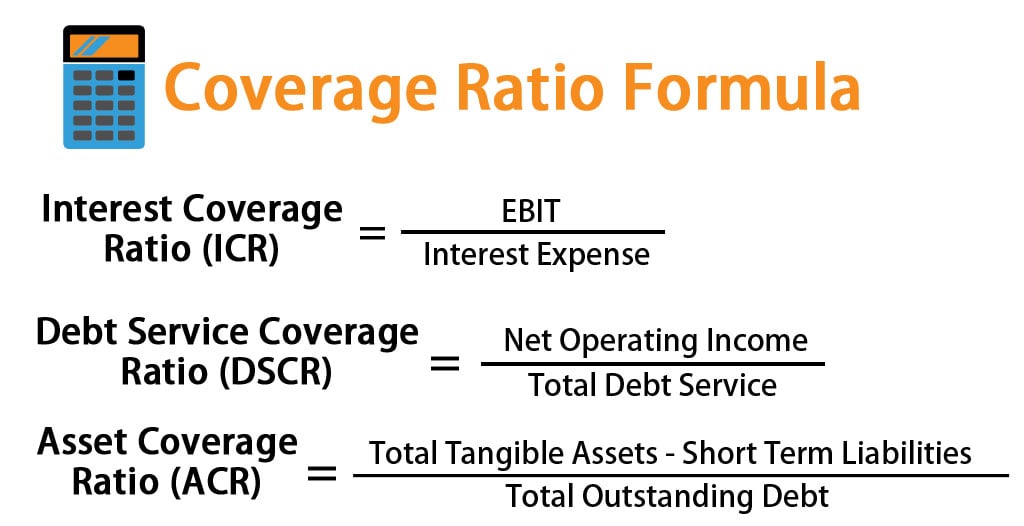

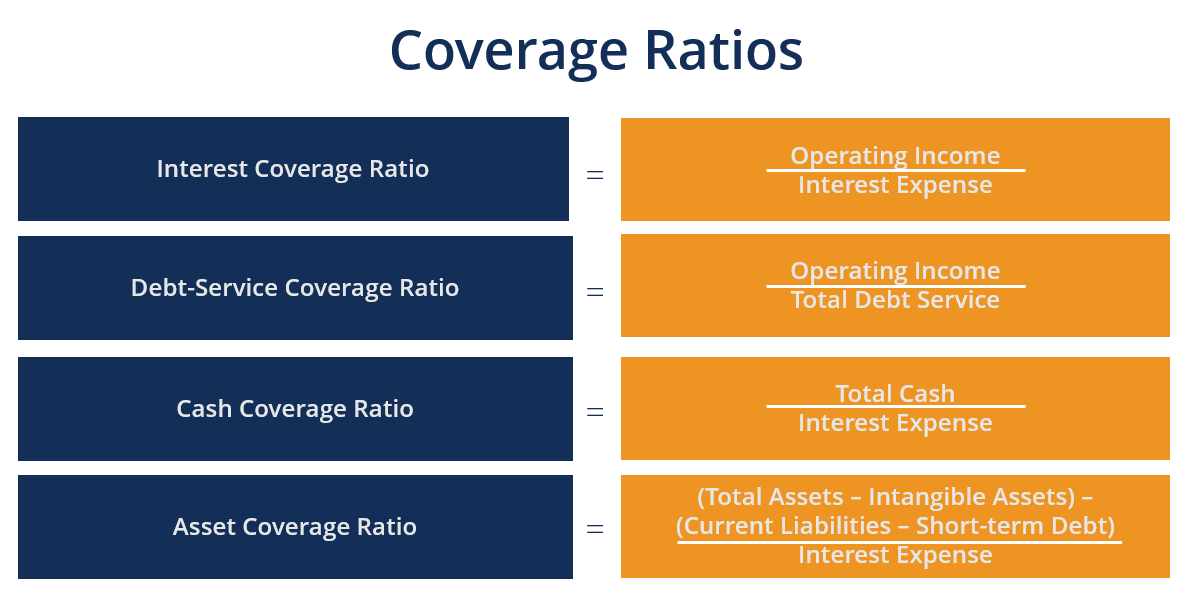

Coverage Ratio Formula How To Calculate Coverage Ratio?

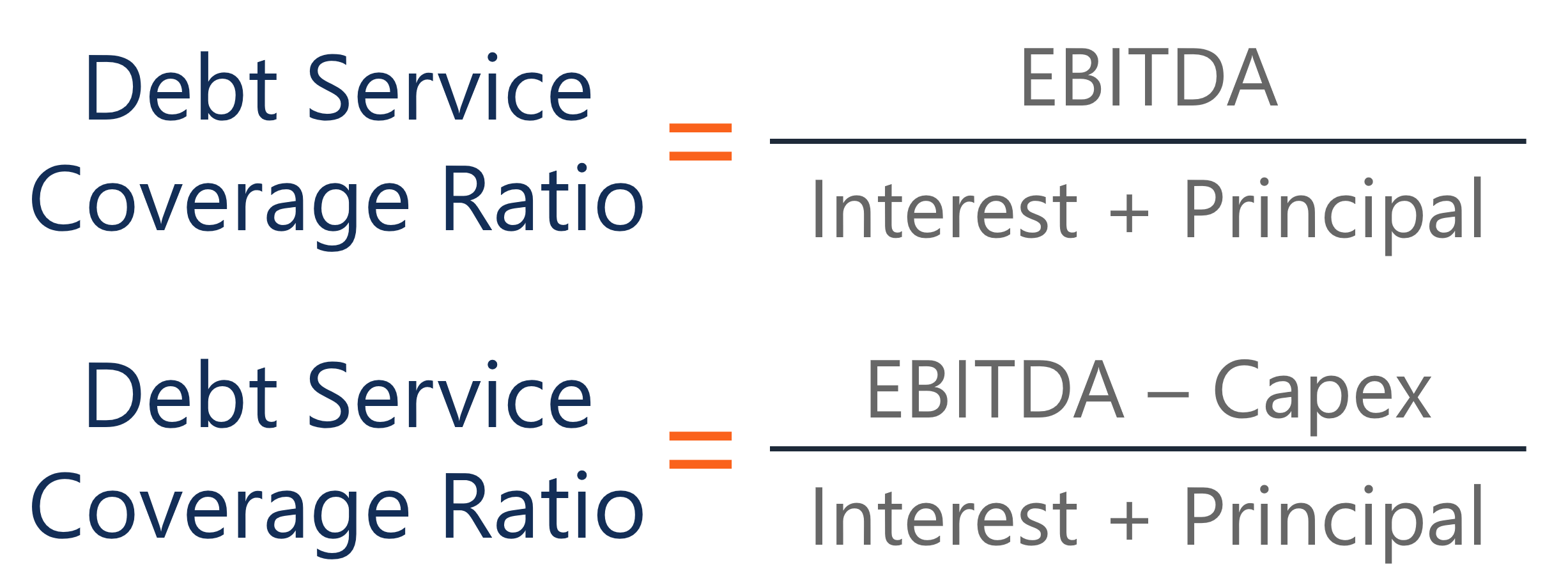

Debt Service Coverage Ratio Guide on How to Calculate DSCR

How to Calculate the Debt Service Coverage Ratio in Excel Party Investors

What Is Debt Service Coverage Ratio (DSCR)? & Its Importance

Debt ratio · Definitie, uitleg en voorbeelden

Debt Service Coverage Ratio Guide on How to Calculate DSCR

Debt Service Coverage Ratio (Formula, Examples) DSCR Calculation YouTube

Debt Service Coverage Ratio (DSCR) Finance Strategists

Debt Service Coverage Ratio (DSCR) A Calculation Guide PropertyMetrics

Debt service coverage ratio definition and meaning

What is the Debt Service Coverage Ratio?

Debt Service Coverage Ratio financepal

:max_bytes(150000):strip_icc()/DSCR-b224f0db64184eae800e27598a8bc2d7.png)

How do you use Excel to calculate debt service coverage ratio (DSCR)? (2022)

Debt Service Coverage Ratio YouTube

:max_bytes(150000):strip_icc()/dscr-5c3dfca4c9e77c00010c0b97.jpg)

DebtService Coverage Ratio DSCR Definition

Coverage Ratio Guide to Understanding All the Coverage Ratios

Debt Service Coverage Ratio (DSCR) berekenen in Excel

Current ratio · Uitleg, Norm en Berekening

What is Debt Service Coverage Ratio(DSCR)Meaning & Formula

Liquiditeit · Berekenen, betekenis & voorbeelden

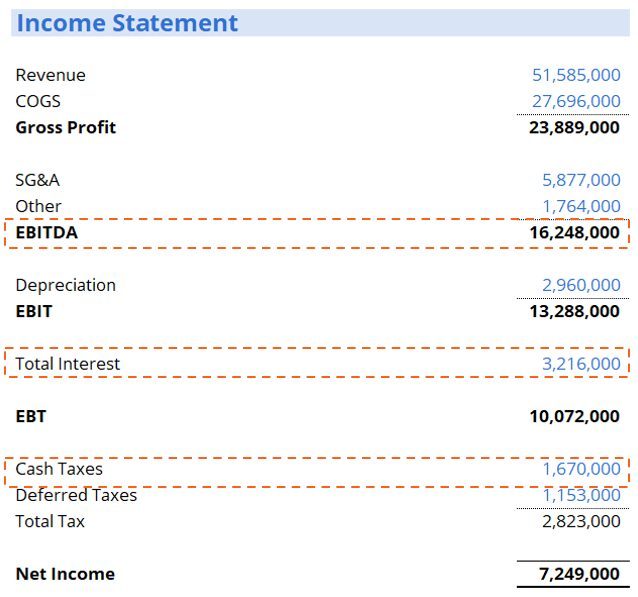

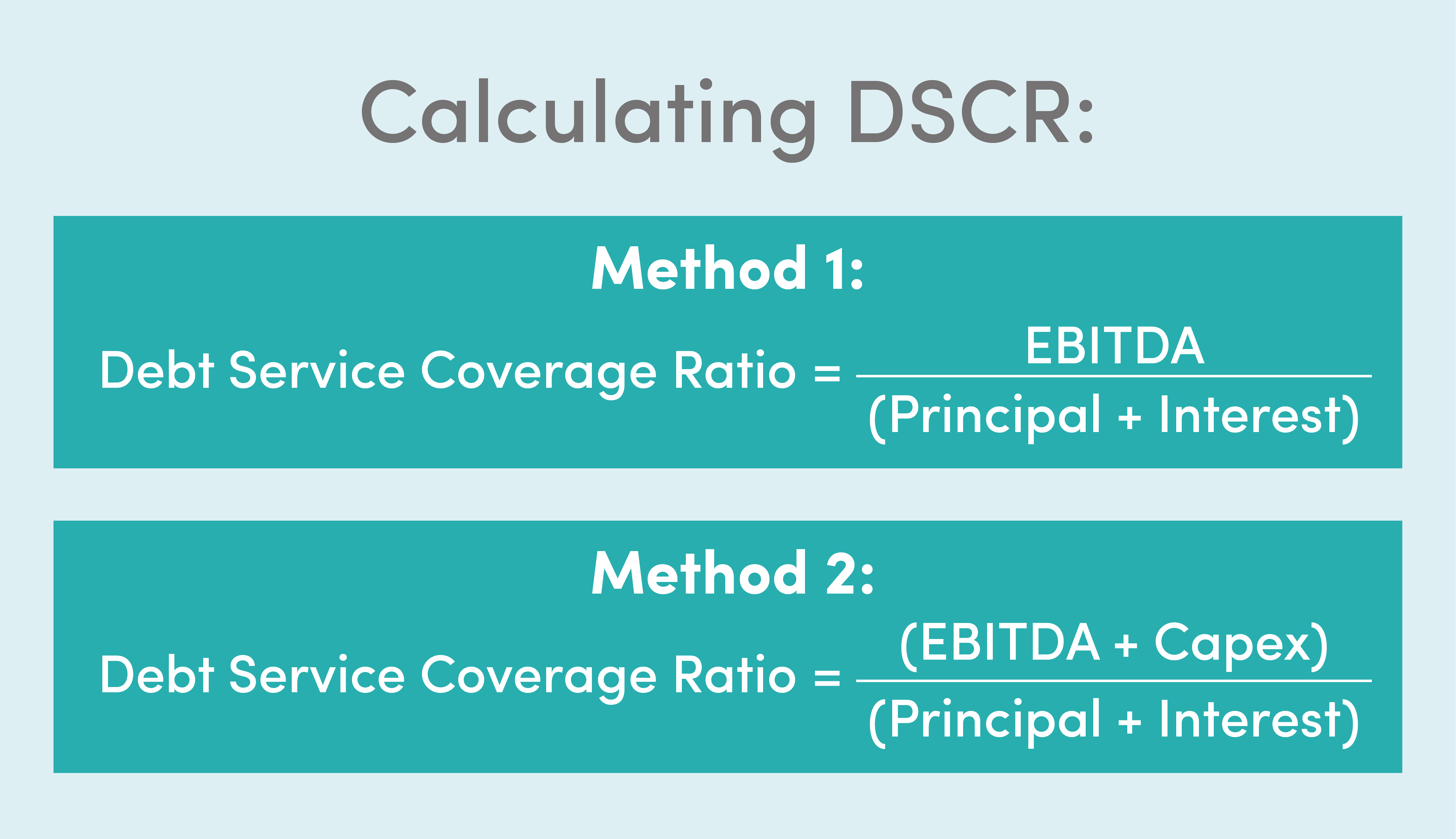

The debt service coverage ratio (DSCR) is a ratio between cash available to a business and cash required for servicing its debt. In other words, it is the ratio of the sufficiency of cash to repay the debt in time. It essentially calculates the repayment capacity of a borrower. A DSCR less than 1 suggests a firm’s cash inability to serve its.. Investopedia. Calculate the debt service coverage ratio in Excel: As a reminder, the formula to calculate the DSCR is as follows: Net Operating Income / Total Debt Service. Place your cursor in.