PM Cares Fund in the light of Right to Information Do PM really Cares?

6,700.00 CA$. Deputy Opposition Whip in the Senate. Salary. 3,300.00 CA$. Member of the House of Commons. Members who occupy certain offices and positions are entitled to additional remuneration in accordance with the Parliament of Canada Act as listed. Basic Sessional Indemnity. 203,100.00 CA$. Prime Minister.. Boris Johnson has registered an advance payment of nearly £2.5m for speaking events, in his latest declaration of outside earnings. It brings the former prime minister’s declared income since.

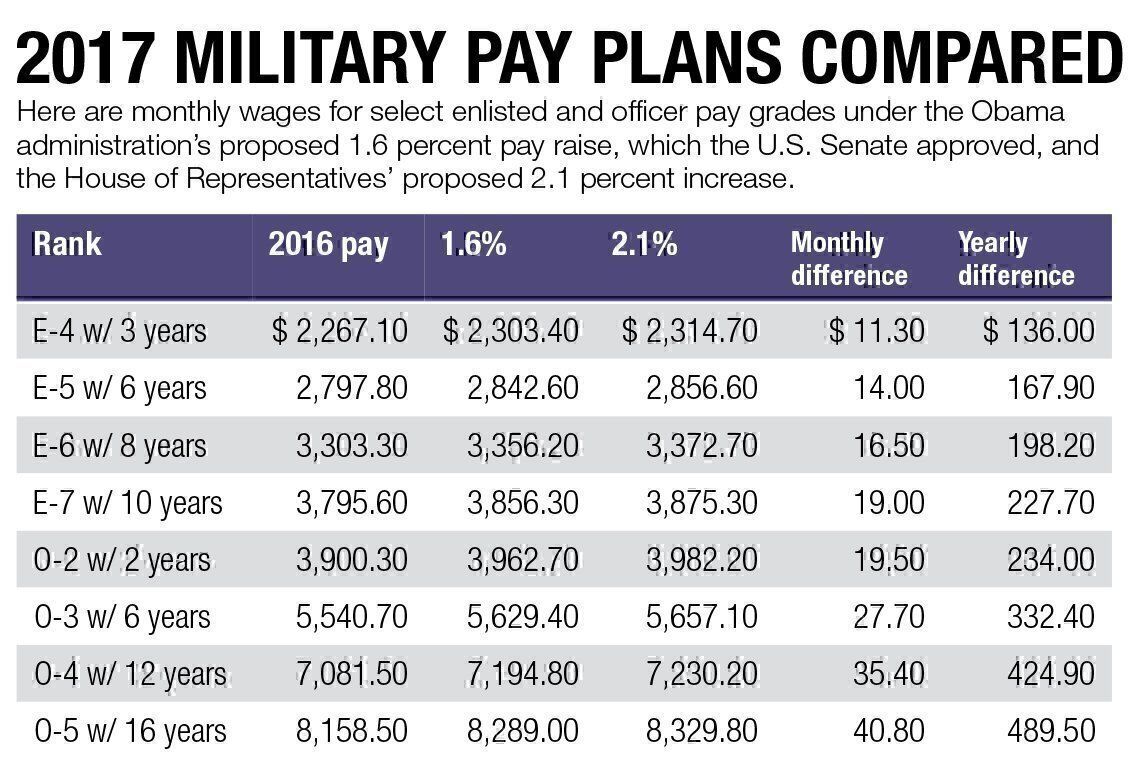

The Army Do You Get Paid In The Army

Army Spouse Separation Pay Chart Army Military

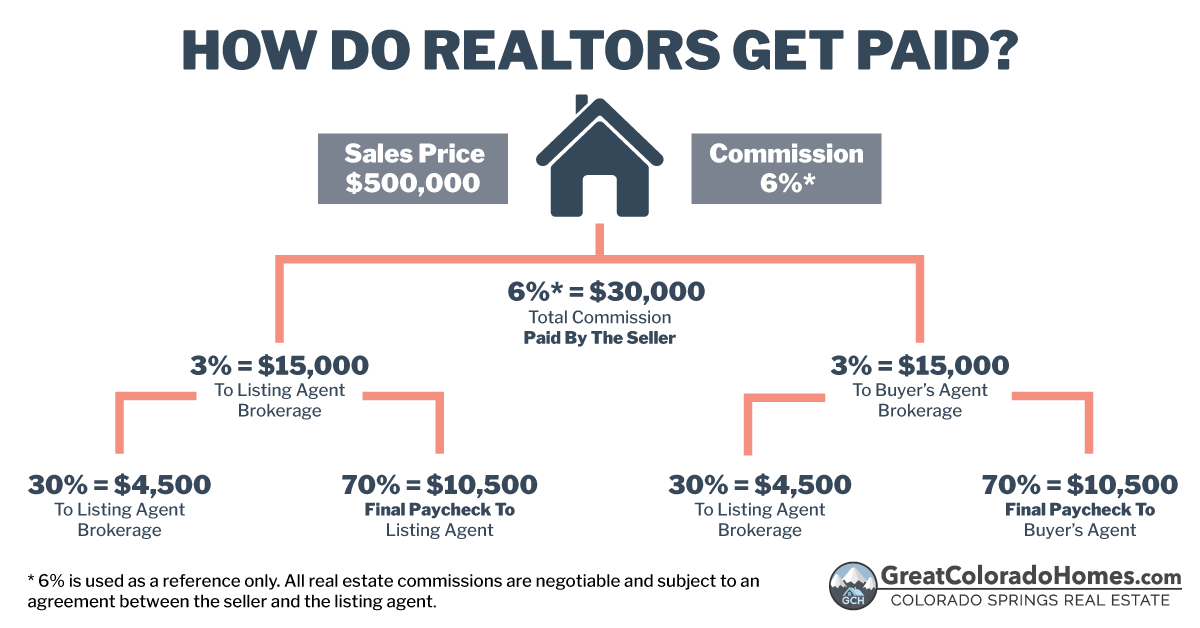

How Do Realtors Get Paid? Who Pays Agent Commissions?

Life of Tax How Much Tax is Paid Over a Lifetime Self.

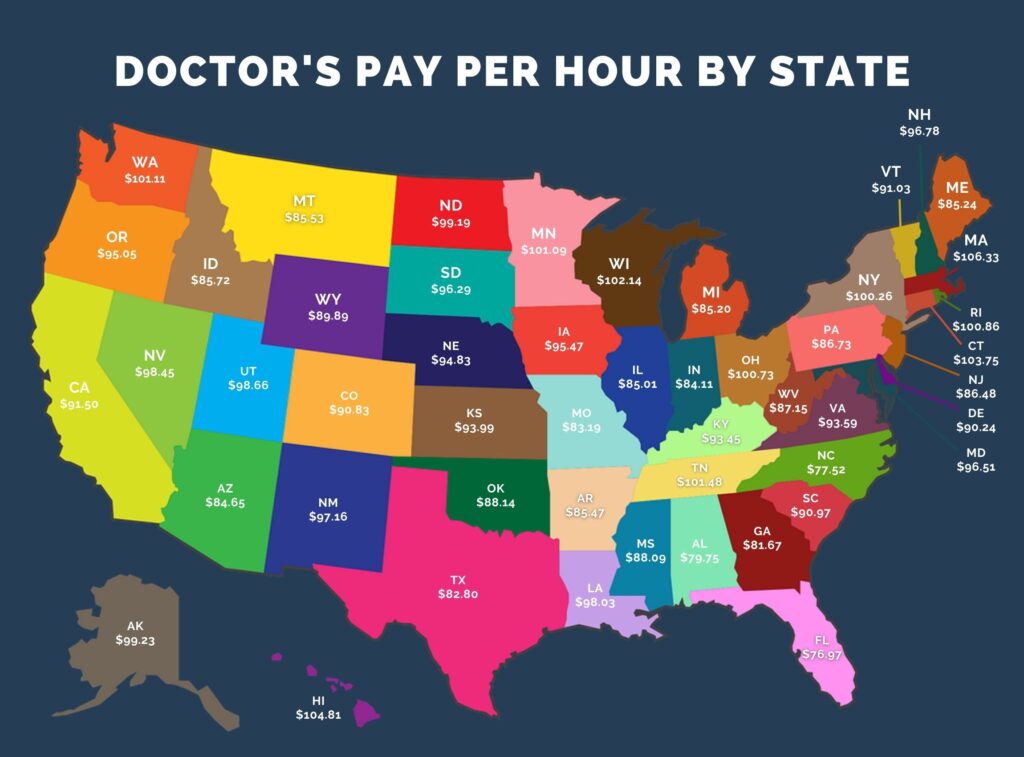

Here’s how much money doctors actually make

New app WageSpot exposes salary data across the country

The Best (And Easiest) Ways To Make Money Overseas

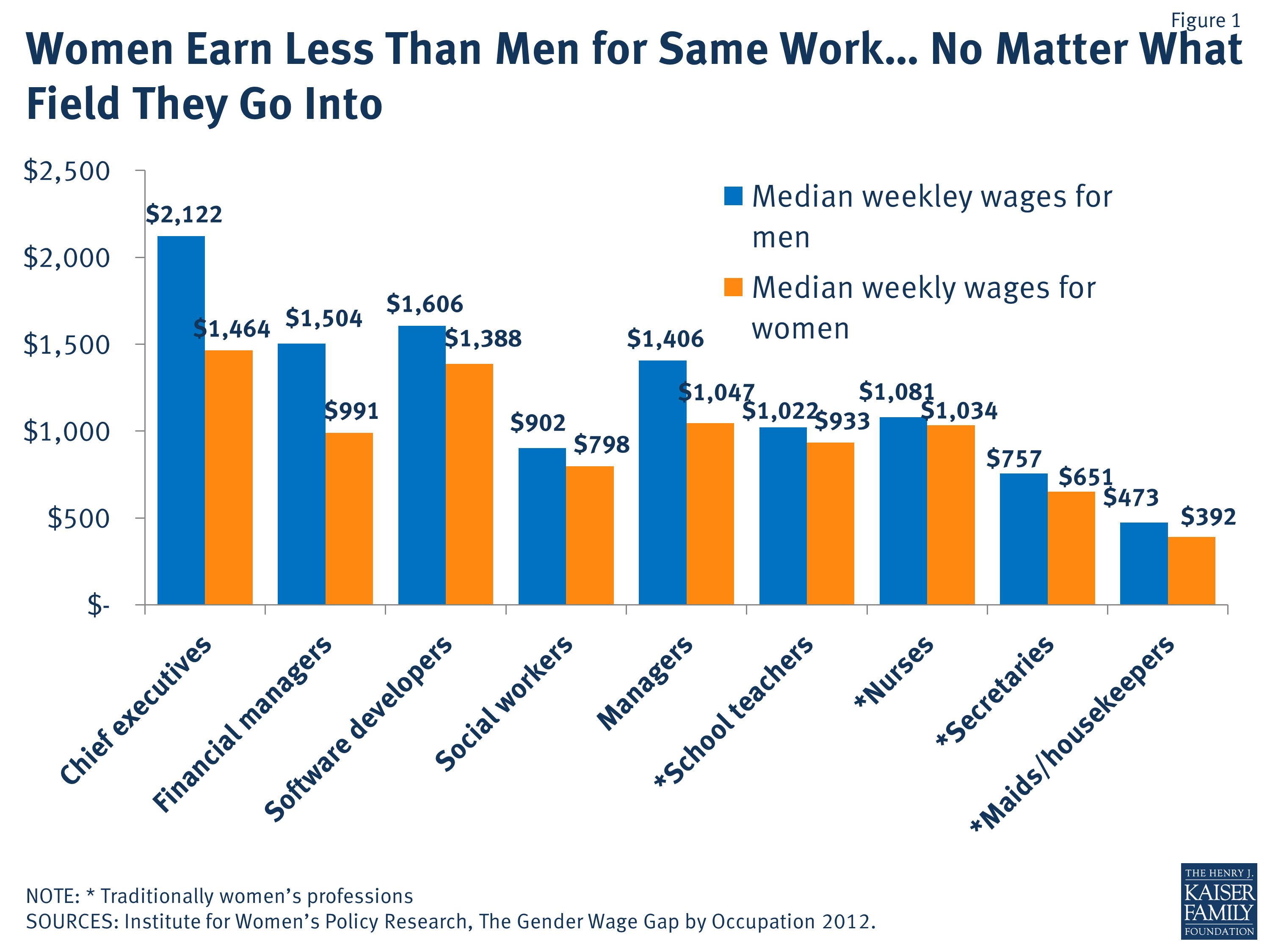

Women Earn Less Than Men for Same Work… No Matter What Field They Go Into KFF

What Type of Lawyers Make the Most Money? Lawrina

How Much Less Are Female Soccer Players Paid? The New York Times

PM Dickon Mitchell says this is how much that was actually paid, And its more than originally

What is PM Modi’s Wealth? How much money PM Modi Earns Modi’s Salary YouTube

How Much Do Doctors Make in An Hour (Breakdown By Specialty) Prep For Med School

CI Post 2…Do Immigrants Pay Taxes?

Do You Get Paid? YouTube

PM Cares Fund in the light of Right to Information Do PM really Cares?

How Much Money Do U.S. Doctors Make Per Year?

Equal Pay Opportunity Act law Washington State Wire

What Are You Getting Paid?

How Much Do You Get Paid For Subscribers On Youtube YouTube

Prime Minister Justin Trudeau’s salary as an MP will increase to the same amount and his top-up pay as prime minister will also increase to $203,100 from $194,600, netting him an increase of.. To determine your hourly gross rate of pay, divide your annual salary by 52.176 to obtain the weekly rate, and then by the number of hours in your standard work week. Example: If your annual salary is $50,000 and you work 37.5 hours a week, your pre-tax rate of pay is $50,000 ÷ 52.176 ÷ 37.5 = $25.55 per hour.